Having led performance marketing for multiple fundraising campaigns of Real Estate Opportunity Zone Fund (Ozone fund), Real Estate Fractional Investment and Crypto Ethereum & Bitcoin Fund, I have been able to dive deeper in different investor segments and what influences their decision to invest in the fund. In this blog, I would be discussing how we raised $100mn for Ozone Fund for a Bay Area real estate company, where I was leading the performance marketing strategy & execution team to acquire investors

Everything started when the client wanted to market one of their opportunity zone fund with a small budget of $5000 to see if they are able to get any investors in the funnel, I did some research about the audience & opportunity zone space to understand who would be potential investors, I learnt that there is a potential in the space as Opportunity Ozone fund is an attractive investment opportunity with tax benefits. After spending $5000 you would be surprised to know that we raise $1.9mn 🙂

This kickstarted the journey for our $100mn Opportunity zone Fund campaign, let’s understand in detail

(Client name & strategy is confidential)

To begin with let’s understand about Opportunity Zone

What is an Opportunity Zone?

Opportunity Zone is an economic development program created by the Tax cuts and Jobs Act of 2017 which allows retail investors to invest in distressed areas in the United States.

The key purpose of this is to spur economic growth and job creation in low-income communities while providing tax benefits to people who invest in the Opportunity Zone fund.

Taxpayers can also invest in these funds through Qualified Opportunity Funds (QOF)

Opportunity Zone Fund is also known as Ozone Fund

Taxpayers can invest in these zones through Qualified Opportunity Funds.

What are the Tax Benefits of Investing in Opportunity Zone Fund?

Now that we have some background about Opportunity zone, let’s get in understanding How to Raise $100mn for Opportunity Zone fund

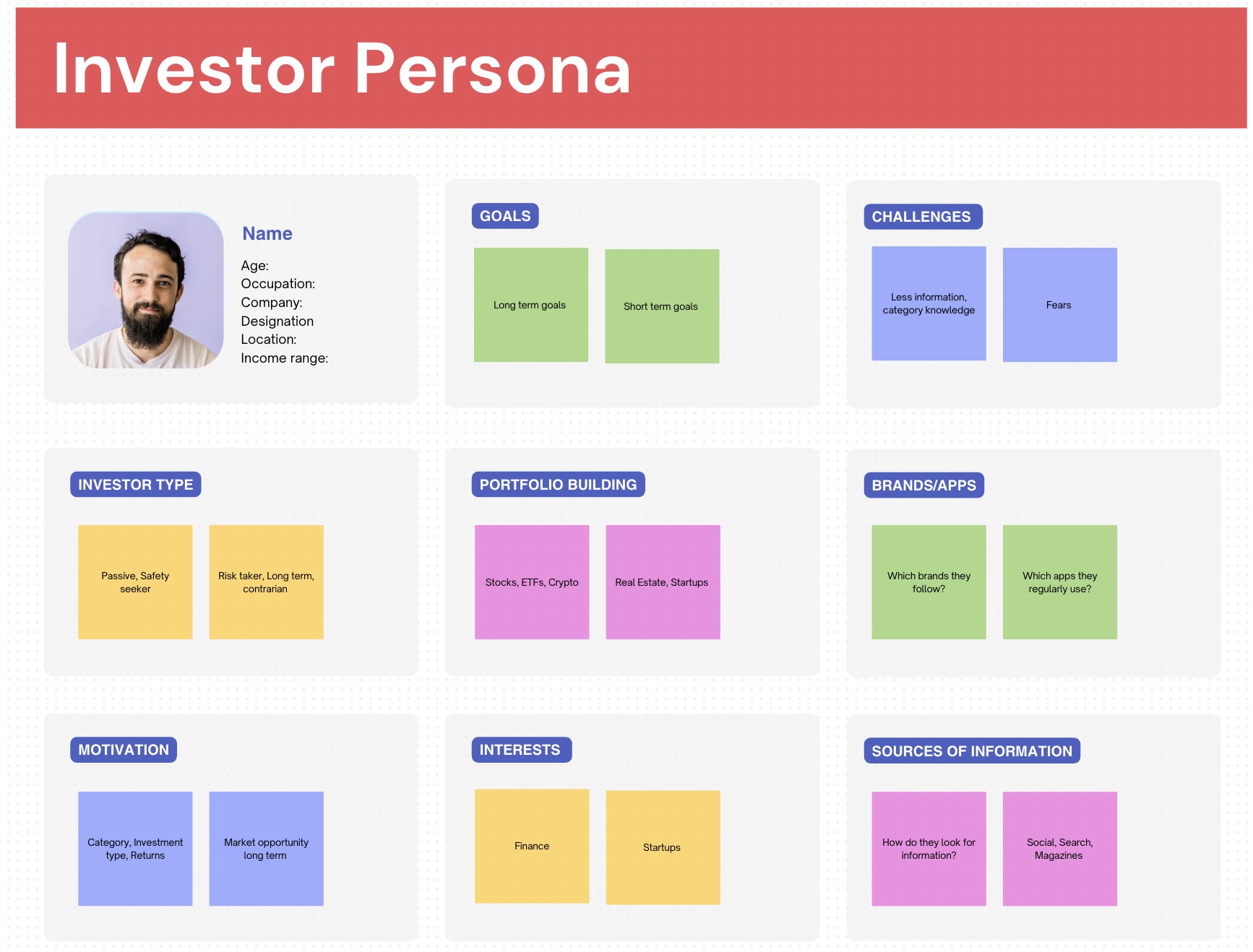

1. Defining Investor Personas

The first step is to understand and define investor personas who would be the potential investors we need to connect with to showcase Opportunity Zone fund opportunity. This will also allow you to target these personas and also define specific messages to each persona.

The investor personas would include Tech HNW, Non-Tech HNW, Wealth Managers & Family Offices. We defined each persona to understand how they are, what they do, how they research, their investment approach and key factors they consider while making a decision.

You can also do this by creating an investor persona including all these pieces.

Above is a simplified example of creating investor persona, you should go as deep as you can to learn more about each persona

To learn more about how to create customer persona, please read article, An Ultimate Guide to Customer Persona

2) Defining Communication Strategy

The next step is to define the communication strategy. Having an effective communication strategy helps to communicate key message of the campaign, connect with the audience and influence their decision.

We defined an impactful communication which resonated with each persona to create awareness, engagement and drive them into the funnel. This strategy was defined after going deeper into below aspects

Communication Objective:

Define what is the objective of the communication, is it to drive awareness, generate interest, engage or convert. This will help you to craft your communication better aligned with your objective.

Competition Insights:

Always try to understand what your competition is communicating through their advertising campaigns, this will help you to avoid similar thought of line while creating your campaigns, plus it will also help you to understand what space they are trying to capture.

Investor Insights:

One of the most valuable aspect is to learn from investor data, their investment approach, their goals, their demographics and psychographics, which will help to make specific communication for different segments. You can also do surveys or interviews, to understand investors methodology for making investment decisions.

Business Proposition:

Clearly define what is the business proposition, why would anyone invest in the fundraise, why it’s a lucrative amazing investment opportunity. Defining these pieces will clearly help to you push on different aspects of the business which would influence decision of the investors, eg: high IRR, algorithmic trading, managing downside, capturing upside, protection and more.

Market Conditions:

Understanding the current market situation is important, because the market might be going down and you are trying to market your fundraise, so what is going to be the investor mindset, will they invest or watch, is something to be looked at

Historic Data:

It’s always good to learn from historic data, historic data helps to understand what has worked and what hasn’t, it also helps us to understand the impact of earlier communication. So it’s a effective practice to learn from historic data and learn form it.

Based on the above aspects we crafted different sets of communication for different stages of the investor journey specific to each segment, making it more relevant and impactful.

3) Defining Media Strategy

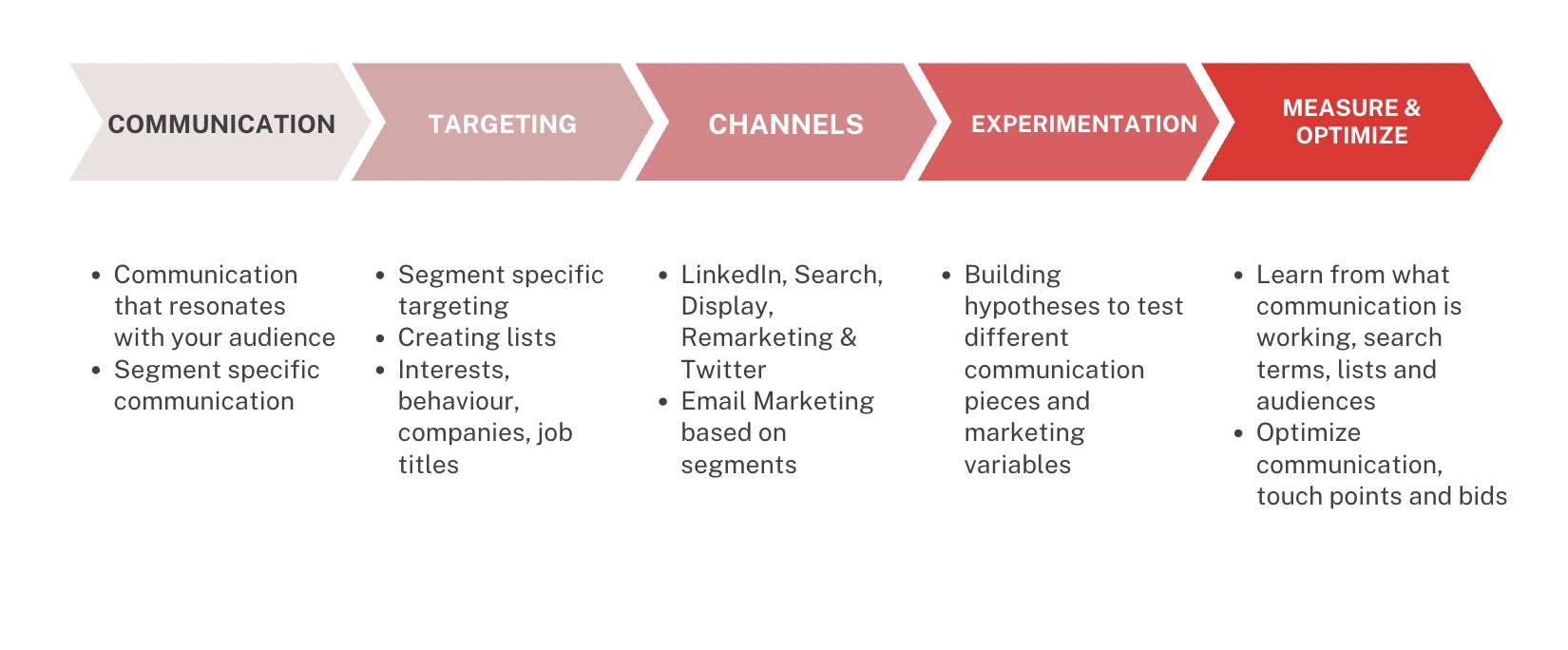

The next step is to define the media strategy. We defined media strategy based on below aspects to drive value from media investments.

Let’s understand each in detail

Communication:

That’s the key message which you would be communicating to your audience. We defined segment specific communication which helped us to connect with the investors better, generating maximum traction from the campaigns.

Targeting:

This is one of the key aspects in the entire media strategy. We defined targeting for each segment at a deeper level, which helped us to reach out to the right audience with effective communication. Further, we also created different list of companies where the investors were working and targeted them. If the targeting is not precise you would end up investing media on irrelevant audiences and see lower traction.

Channels:

Channels include which platforms and properties you would be using through your marketing campaign, eg: Search, Display, Programmatic, LinkedIn, Twitter, Email and more. Based on different segments we decided which channels are suited and then allocated budgets for each segment with breakdown of channel media investment. This helped us to invest media in the right direction, generating higher investor leads into the funnel.

Experimentation:

Experimentation is an effective practice, it allows us to test different aspects of the campaigns including ad communication, landing pages, CTAs and more. We build hypothesis to test different variables which helped to get investors in the funnel.

Measurement:

It’s important to measure how different channels, segments and campaigns are performing. Before the campaigns we decided which metrics we want to track and on what channels, which eventually helped us to optimize and scale our marketing campaigns

So this is how we were able to generate $100mn for opportunity zone fund campaign

Conclusion:

Digital Marketing will help you to reach out to wider pool of investors and build visibility of your fund. The success of your marketing campaign will depend on the how precisely you have defined your investor segments, how you have defined your marketing communication and how you have leveraged different channels to target investors. Hope this gives a fair idea to go about fundraising campaigns. Let me know your thoughts!

If you are looking for Opportunity Zone Marketing Agency, you can contact us R Interactives

Similar Article: Fractional Real Estate Investor Marketing Case Study