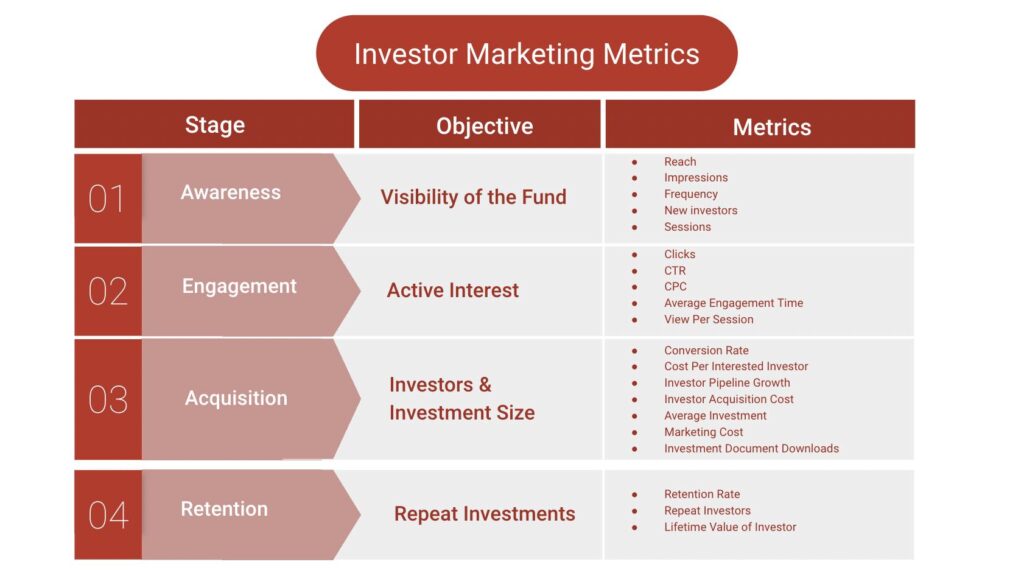

When promoting your Opportunity Zone, Fractional Investment, or Alternative Real Estate Investment product, it becomes crucial to assess metrics at every step of the investor journey. This article will emphasize the essential metrics in investor marketing, enabling you to gauge your marketing program, base decisions on data, and engage potential investors more effectively.

Stage 1: Awareness

Reach:

Reach refers to the total number of unique individuals or households exposed to a particular marketing campaign or message within a given time frame. It measures the size of the audience your campaign has reached.

Impressions:

Impressions represent the total number of times your content or advertisement is displayed to users, regardless of whether it was clicked or engaged with. It measures the potential exposure of your message to the audience.

Frequency:

Frequency measures how often, on average, a user within your target audience is exposed to your marketing message or advertisement during a specific campaign. It helps assess how frequently the same users encounter your content.

New Users:

New users, often referred to as “unique visitors” or “first-time visitors,” are individuals who have interacted with your website for the first time during a specified period. These users are typically distinct from returning or existing users.

Sessions:

A session represents a single, continuous visit by a user to your website. It starts when a user initiates activity (e.g., loading a web page) and ends when there is a period of inactivity or when the user leaves the website. Sessions are used to measure user engagement and interactions within a specific time frame.

Stage 2: Consideration

Clicks:

The term “clicks” refers to the action taken by an investor when they interact with an investment opportunity advertisement or a clickable element within a digital marketing campaign. When an investor clicks on an ad, it typically signifies their interest in the content or brand.

CTR:

Click-through rate (CTR), which is the ratio of clicks to ad impressions (the number of times the ad is shown). CTR is expressed as a percentage and helps advertisers understand how well their ad copy, design, and targeting strategies are performing. A higher CTR indicates that a higher proportion of investors who saw the ad clicked on it, which is generally considered a positive outcome.

CPC:

Cost-Per-Click (CPC): In many advertising models, advertisers pay for each click their ad receives. This is known as cost-per-click (CPC). Advertisers bid on keywords or placements, and they are charged when an investor clicks on their ad. CPC can vary widely depending on factors like competition, industry, and targeting options.

Average Engagement Time:

Average engagement time measures the amount of time investors spend interacting with a specific piece of content or a website. It helps gauge the level of interest and attention your content is receiving from investors. It can be further used to assess how long potential investors are engaging with your investment materials or presentations. A longer average engagement time typically suggests that your content is holding the investor’s interest.

Views Per Session:

Views per session, also known as pages per session, is a metric that calculates the average number of pages or content views an investor views during a single visit on a website. It measures the depth of engagement and the extent to which investors explore your digital assets. This metric can provide insights into how extensively potential investors are exploring your investment information. A higher views per session can indicate greater interest and engagement with your materials.

Stage 3: Acquisition

Conversion Rate:

Conversion rate is a metric that measures the percentage of investors who take a desired action after interacting with your marketing or investment materials. It typically refers to the percentage of individuals who become investors or take a specific investment-related action, such as subscribing to updates or enquiring

Cost Per Interested Investors:

Cost per interested investor, also known as Cost Per Lead (CPL) in marketing, calculates the average cost incurred to generate interest or leads from potential investors. It is calculated by dividing the total marketing costs by the number of interested investors or leads generated. This metric helps you assess the efficiency and cost-effectiveness of your investor acquisition efforts.

Investor Pipeline Growth:

Tracking the growth of your investor pipeline is crucial. It shows how successful your marketing efforts are at attracting new potential investors. A growing pipeline can indicate increased interest in your investment/fund opportunities.

Number of Investors:

The number of investors is a straightforward metric that counts the total quantity of individuals or entities who have invested in your offering, fund, or project. This metric provides a clear indication of how many investors have committed capital to your investment opportunity.

Investor Acquisition Cost:

Investor acquisition cost (IAC) is a metric that quantifies the expenses associated with acquiring new investors. It includes various costs related to marketing, outreach, presentations, and other activities aimed at attracting and converting potential investors. IAC is calculated by dividing the total acquisition costs by the number of new investors acquired during a specific period.

Average Investment:

Average investment refers to the average amount of capital invested by each individual or entity who participates in your investment opportunity. It is calculated by dividing the total investment amount (or fund size) by the number of investors. This metric provides insights into the typical investment size within your investor base.

Marketing Cost:

Marketing cost is the total amount spent on marketing and promotional activities specifically related to your investment opportunity or fund. It includes expenses such as advertising, content creation, event participation, and webinars. You can also calculate media cost separately to understand how your marketing campaigns have performed. Ideally, marketing cost should less less than 1% of your total investment.

Stage 3: Retention

Retention Rate:

Don’t forget about your existing investors. Monitoring the retention rate among your current investors is vital for maintaining a healthy investor base. High retention rates indicate satisfied investors who are more likely to continue supporting your business.

Repeat Investor

A repeat investor, also known as a returning investor, is an individual, entity, or organization that has previously invested in a particular investment opportunity, fund, or project and chooses to invest again in the same or a similar opportunity. Repeat investors are those who have demonstrated confidence in the investment issuer, strategy, or asset class by making multiple investments over time.

Investor Lifetime Value (ILV)

Investor Lifetime Value (ILV), similar to the concept of Customer Lifetime Value (CLV) in marketing, is a metric used to assess the long-term financial value that an individual investor or group of investors can generate for a company or investment opportunity over their entire investment relationship. ILV takes into account not just the initial investment but also the potential for additional investments, reinvestments, and the duration of the investor’s engagement with the company or investment vehicle.

Key components of Investor Lifetime Value may include:

- Initial Investment: The amount of money the investor initially commits to the investment opportunity or fund.

- Additional Investments: Any subsequent investments made by the investor over time, such as reinvestments, follow-on investments, or contributions to new opportunities offered by the same issuer.

- Investment Duration: The length of time the investor remains actively engaged with the investment, including the time between initial and subsequent investments.

- Returns and Gains: The total returns, profits, or gains generated by the investor’s investments over their entire investment journey.

- Referrals and Network Effects: If applicable, ILV can also factor in the potential for investors to refer others or bring in additional investors to the same opportunity, further enhancing the value they bring to the issuer.

Investor Lifetime Value helps companies assess the overall financial impact and profitability of maintaining relationships with investors over the long term. It can inform strategic decisions related to investor engagement, communication, and retention efforts, as well as provide insights into the potential for growth and sustainability of an investment vehicle or offering. By understanding and maximizing ILV, issuers can build stronger relationships with investors and drive continued support for their investment initiatives.

Conclusion

In conclusion, understanding and effectively utilizing investor marketing metrics are essential for any organization seeking to attract and retain investors. By focusing on these key metrics throughout the investor journey, businesses can make data-driven decisions, measure the success of their marketing efforts, and engage with potential investors more efficiently.

Metrics like conversion rate, the number of investors, cost per interested investor, investor acquisition cost, marketing cost, and average investment provide invaluable insights into the performance and cost-effectiveness of investor marketing campaigns. They allow businesses to fine-tune their strategies, allocate resources wisely, and nurture relationships with both new and repeat investors.

Investor marketing is not just about attracting capital; it’s about building trust, credibility, and long-term partnerships with your investor community. By leveraging the power of these metrics, companies can not only secure investment but also foster a supportive and enduring investor base, ultimately driving the growth and success of their investment initiatives.