What is Fractional Investment in Real Estate

Fractional investment in real estate is a method that allows multiple investors to pool their money together to purchase shares or fractions of a property. Instead of one individual or entity owning the entire property, it is owned collectively by a group of investors, each holding a piece of the investment.

How Fractional Investment Works?

Shared Ownership:

Multiple investors own a portion of the real estate asset. This could be residential, commercial, or any other type of property.

Lower Financial Barriers:

Because the investment is fractional, individual investors can participate in the real estate market with a much smaller amount of capital than would be required to purchase a whole property.

Management:

The property is typically managed by a professional management company or through a platform that facilitates the fractional ownership. This means that individual investors do not need to manage the property directly.

Income and Appreciation:

Investors may earn income from the property in the form of rent, and they may also benefit from appreciation in the property’s value over time.

Liquidity:

Some fractional investment opportunities offer higher liquidity than traditional real estate investments. Depending on the structure of the investment, there might be a marketplace for buying and selling fractions of the property, though this is often less liquid than other types of investments like stocks.

Regulatory Framework:

Fractional investments are typically subject to securities regulations, as the fractional shares are considered securities. Investors often participate through platforms that comply with relevant laws and regulations.

Accessibility:

Fractional ownership can make investment opportunities available to a broader audience, democratizing access to real estate markets that may have been out of reach for many investors due to high capital requirements.

Diversification:

Since the entry cost is lower, investors have the opportunity to spread their investment across multiple properties or types of properties, potentially reducing risk through diversification.

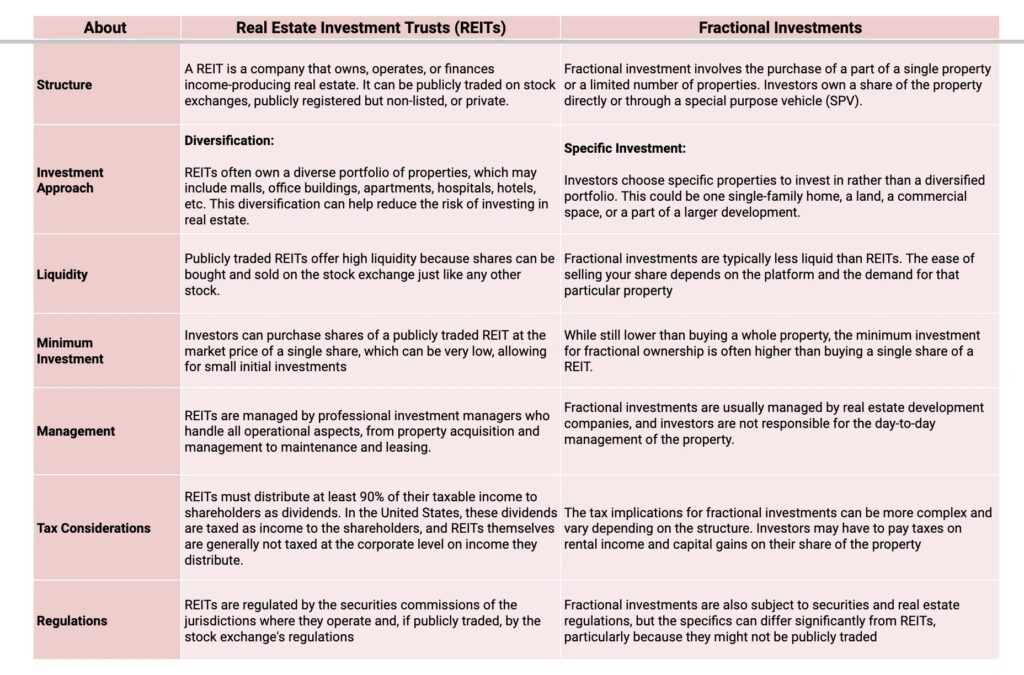

Real Estate Investment Trusts (REITs) Vs Fractional Investments

In summary, REITs offer a way to invest in a diversified portfolio of real estate with high liquidity and low minimum investment, much like buying stocks. Fractional investments, on the other hand, offer a more direct investment in specific properties, usually with less liquidity and a higher minimum investment but potentially more control over the choice of property. Investors might choose between them based on their investment goals, liquidity needs, risk tolerance, and interest in specific types of real estate.

Future of Fractional Investments

The future of fractional investments in real estate appears promising, driven by several key trends and factors:

Technological Advancements:

The rise of blockchain and other secure platforms for managing fractional ownership has made it easier for investors to buy and sell fractions of properties. Technology is expected to continue to make fractional ownership more accessible and efficient.

Democratization of Investing:

There’s a growing appetite for investment opportunities that are accessible to a wider audience, not just high-net-worth individuals or institutional investors. Fractional investment opens up real estate to people who might not have the capital to invest in property otherwise.

Economic Factors:

In the face of economic uncertainty, investors often look for tangible assets like real estate as a hedge against inflation and volatility. Fractional investment allows for this kind of diversification without the need for substantial capital.

Regulatory Environment:

As regulators become more familiar with fractional ownership, there may be more clarity and standardization in laws, which could encourage more people to invest.

Urbanization and Housing Demand:

As urban areas grow, the demand for housing can outpace supply, driving up property values. Fractional investment allows investors to capitalize on this growth.

Market Fluctuations:

Real estate markets go through cycles. Fractional investment platforms could provide more flexibility for investors to enter and exit real estate positions in line with market conditions.

Global Reach:

Fractional investment platforms can allow investors to diversify not just across property types but also geographically, without the complexity traditionally associated with foreign property ownership.

Societal Changes:

Younger generations may be less interested in traditional property ownership due to affordability issues, changing work habits, and a preference for mobility. Fractional ownership can align with their lifestyle and investment preferences.

Investment Education:

As more educational resources become available, potential investors will become better informed about the benefits and risks of fractional real estate investment, likely increasing participation.

While these trends suggest growth potential, the future will also depend on economic stability, investor confidence, market regulations, and the performance of the real estate market overall. Moreover, like any investment, fractional investments carry risks, and their popularity will hinge on the ongoing balance of those risks with the potential rewards.